REV – Expert Valuer in Real Estate Property |

Valuer in Real Estate Property |

Valuer in Machinery, Plant & Equipment |

REV – Expert Valuer in Real Estate Property |

– The international nature of real estate markets, particularly for a country like Greece, which looks forward to international funds that will invest in the local real estate market, makes the cross-border cooperation between valuers a necessity.

– The “opening” of the Greek valuation market, along with the abolition of the Body of Sworn-in Valuers (BSV/SOE) necessitated the need of increased qualifications for registration in the Register of Certified Valuers of the Ministry of Economics, which succeeded BSV.

- In other words, the necessity exists both in Greece and across the European market.

- For this reason, the REV status, from the very start was – and still is – broadly accepted by both the real estate community and by the market in general.

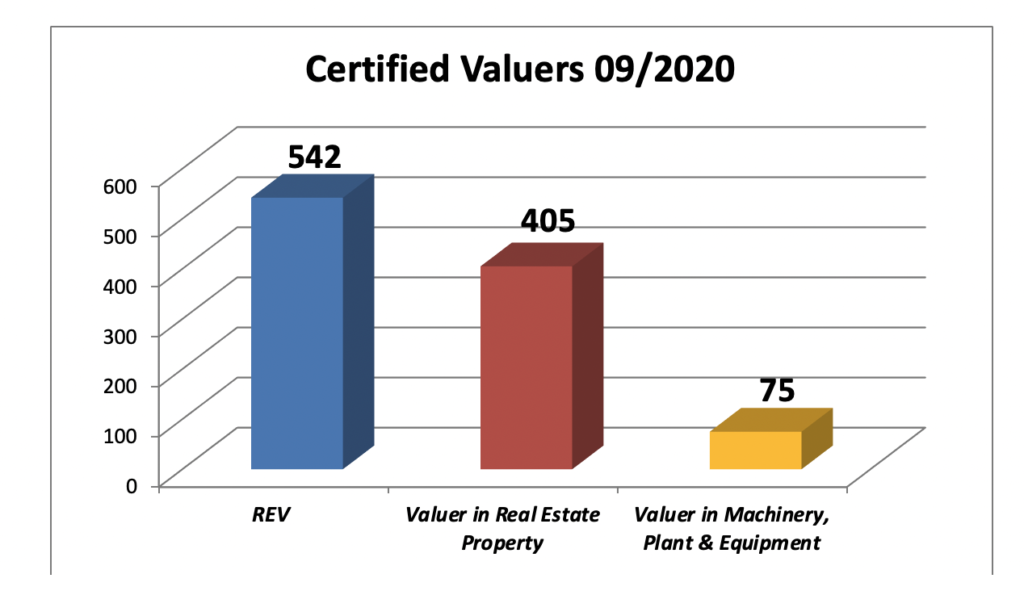

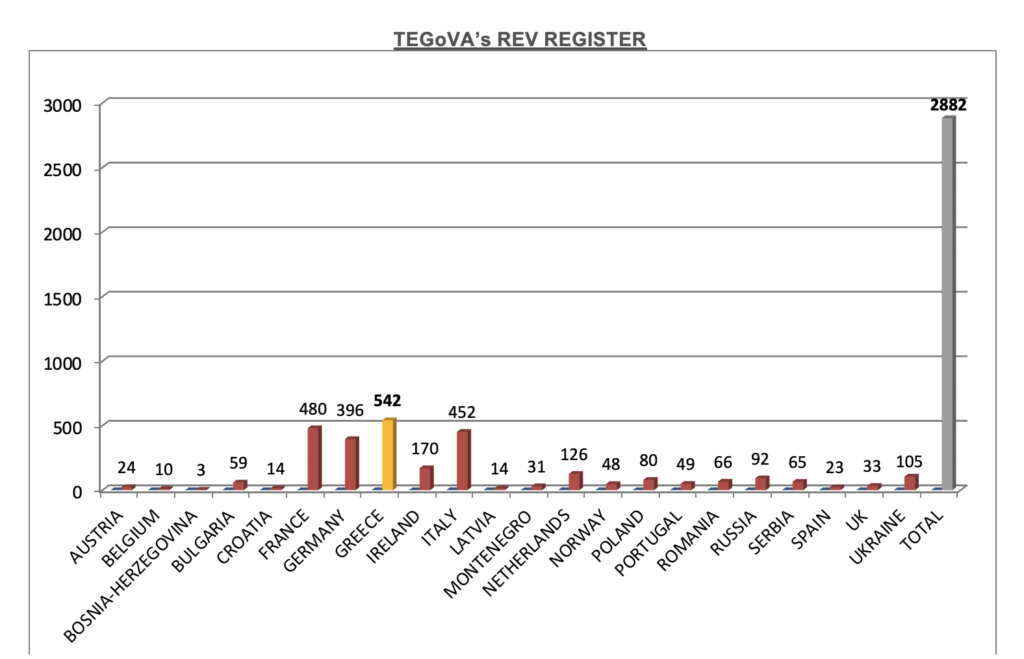

- Today there are 542 Recognized European Valuers in Greece and totally 2.882 across Europe.

How To Attain REV Status

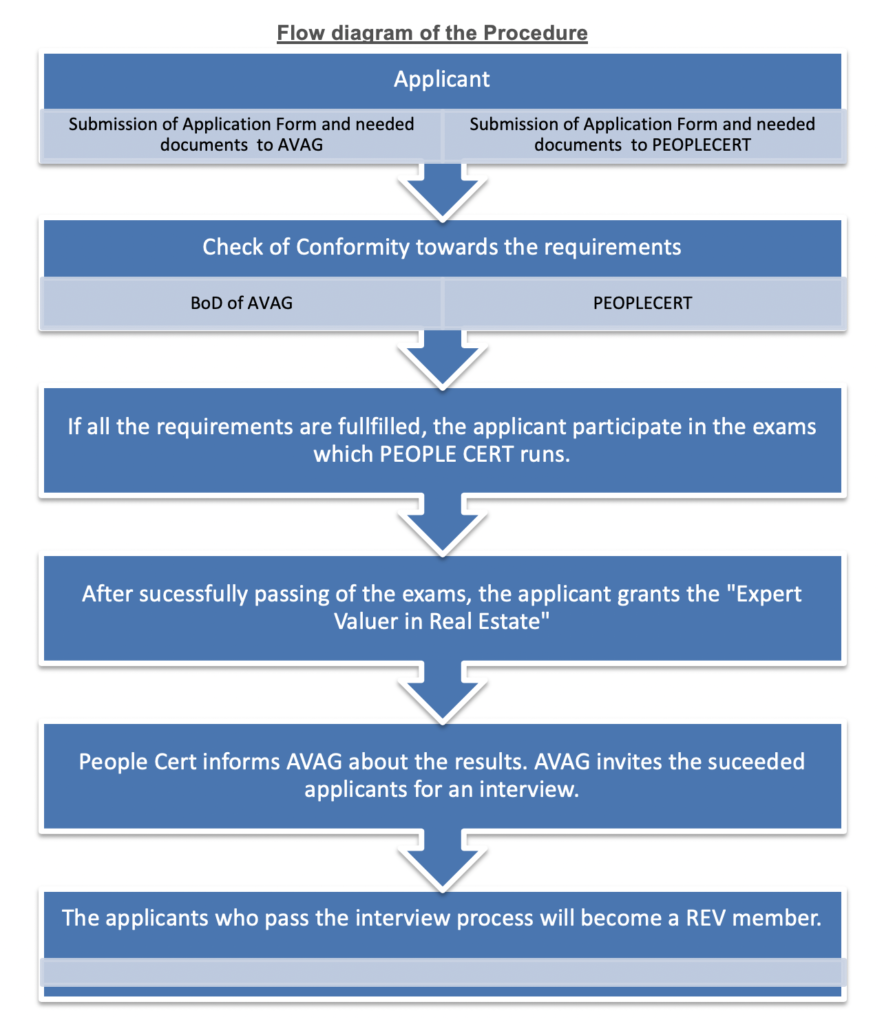

In Greece the REV status can be attained only by members of the Association of Greek Valuers (AVAG/Σ.ΕΚ.Ε.), which is a recognized Member Assocciation by TEGoVA and has been authorized to award the REV status.

That means that AVAG:

- meets the standards required by TEGoVA

- has signed a Recognition Convention

- covers the financial obligations of the Recognition Convention

- is being monitored periodically for compliance with the Recognition

Regular members of AVAG, who cover the requirements listed in the following table and succeed in written exams, in order to ensure that they possess the minimum level of knowledge established by the TEGoVA, are eligible to the REV status

The knowledge fields that are examined are:

- Principles of economic theory, Business financial, Economics of real estate market

- Design and construction, Energy, Environment and natural resources protection, Brokerage

- Legislation (relative to real estate), Taxation (relative to real estate) Land policy, Ethics

- Valuation theory and standards

The candidate who succeed the exams and is nominated with the «Recognised European Valuer» status has the right to use this title, as well as the distinctive REV after his name. The certification is valid for five (5) years. After that period elapse, the valuer should proceed to the renewal of the certification. If the valuer does not succeed in the renewal process, automatically and immediately cease to be entitled to the «Recognised European Valuer» status, and the distinctive REV.

In Greece, a prerequisite for obtaining the «Recognized European Valuer» (REV) status, which is granted to the members of AVAG, under the Recognition Convention by TEGoVA, is simultaneously the acquisition of the certification «Expert Property Valuer» by PEOPLECERT. The exams are common, and the procedure is governed by the “Candidate Certification Regulations” and «Syllabus» of Professional Valuers Certification scheme of PEOPLECERT, which has been also approved by the TEGoVA.

Qualifications for the REV Status

|

Academic qualifications |

a) Bachelor degree in the following fields: – Engineering (architects, civil engineers etc) – Economics – Real estate valuation or b) Post graduate degree in real estate valuation

|

|

Minimum evidence of valuation experience |

a) At least five (5) years of proven experience in valuations, during the last ten years, after the acquisition of the bachelor degree or

b) At least three (3) years of proven experience in valuations, during the last ten years, after the acquisition of the post graduate degree(*) *acceptable postgraduate degrees are all degrees which have at least one course in c) At least 20 valuation reports during the last two (2) years from which 50% must refer to complex properties (Hotels, industrial, mix used buildings etc) and d) 20 hours of formal learning activities (seminars, conferences, etc) |

|

Basic skills |

Principles of valuation, implementation of valuation methods, valuation institutional framework, valuation standards (local, european and international), analysis and appraisal of investments.

|

Valuer in Real Estate Property |

The Association of Greek Valuers in collaboration with the professional certification body PEOPLECERT and in cooperation with Athens University, established national certification scheme in real estate property. The scheme is accredited by the Greek National Accreditation Body.

Qualifications for the Valuer in Real Estate Property Status

|

Academic qualifications |

a) Bachelor degree in the following fields: – Engineering (architects, civil engineers etc) – Economics – Real estate valuation or b) Post graduate degree in real estate valuation

|

|

Minimum evidence of valuation experience |

a) At least two (2) years of proven experience in valuations, during the last five years, after the acquisition of the bachelor degree or

b) At least 10 valuation reports during the last two (2) years c) 20 hours of formal learning activities (seminars, conferences, etc) |

|

Basic skills |

Principles of valuation, implementation of valuation methods, valuation institutional framework, valuation standards (local, european and international), analysis and appraisal of investments.

|

Valuer in Machinery, Plant & Equipment |

The Association of Greek Valuers in collaboration with the professional certification body PEOPLECERT and in cooperation with Athens University, established national certification scheme in machinery, plant & equipment. The scheme is accredited by the Greek National Accreditation Body.Qualifications for the Valuer in Machinery Status

|

Academic qualifications |

a) Bachelor degree in the following fields: – Engineering (architects, civil engineers etc) – Economics – Real estate valuation or b) Post graduate degree in real estate valuation

|

|

Minimum evidence of valuation experience |

a) At least two (2) years of proven experience in valuations, during the last five years, after the acquisition of the bachelor degree or

b) At least 10 valuation reports during the last two (2) years c) 20 hours of formal learning activities (seminars, conferences, etc) |

|

Basic skills |

Principles of valuation, implementation of valuation methods, valuation institutional framework, valuation standards (local, european and international), analysis and appraisal of investments.

|